Do I need to pay in 2017?

Yes, but only the prorated amount corresponding to the time left in 2017 from the moment the new law is enacted (September, October, November,

and December). Starting in 2018, the fee will correspond to the full twelve months of the year.

How will the payment be made?

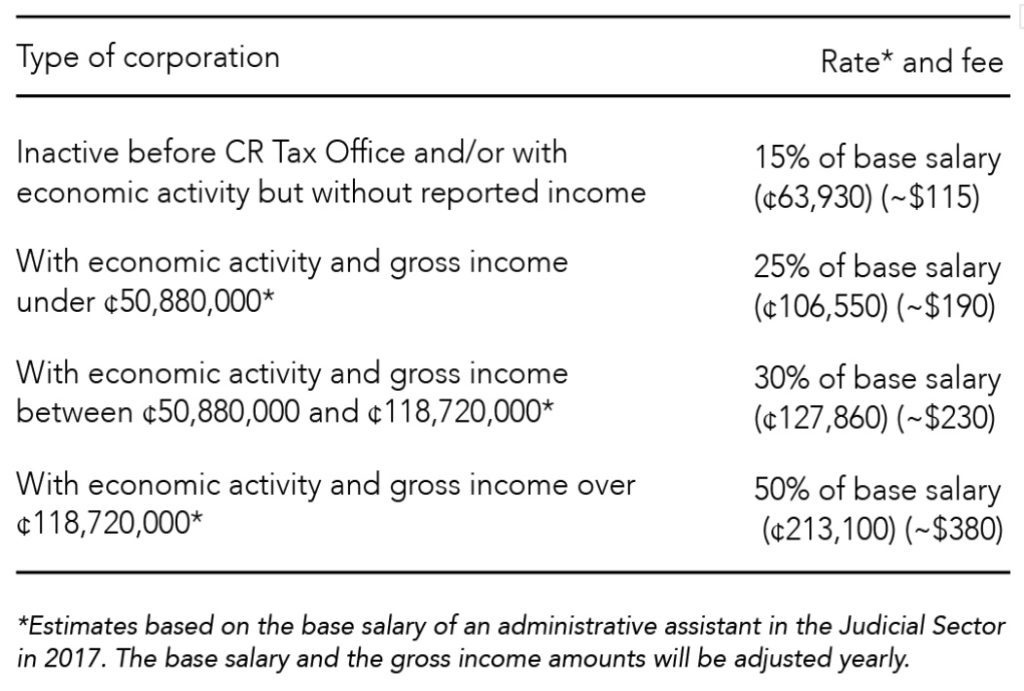

The tax will be collected by the Dirección General de Tributación (CR Tax Office) on an anual basis corresponding to the fiscal year from January 1st to December 31st. The procedures and conditions for payment will be established by the CR Tax Office. The tax will not be a deductible expense when determining income tax.

For corporations that are already registered, the tax will be applied beginning on January 1st. These corporations will have to pay within the first 30 days following January 1st of each year. For corporations registering during the fiscal year, the tax will apply at the moment the deed is presented before the National Registry. In this case, the corporation will

pay 15% of the base salary proportional to the time that remains between the registration date and the end of the fiscal year. These corporations will have to pay within the first 30 days following the date of registration with the National Registry.

What happens if I do not pay?

Sanctions and penalties established in the Código de Normas y

Procedimientos Tributarios (CR Code of Taxation Rules and Procedures)

will apply. Additionally, the National Registry will not issue, certify, or register any documents for the corporations. Furthermore, overdue corporations will not be able to contract with the Government or any public institution. If the tax is not paid for three consecutive years/periods, the corporation will be dissolved.

The company’s legal representative will be jointly and severally liable for both declaring and paying this tax.

The CR Tax Office will create a database that can be consulted electronically so that the public can verify whether tax payments are up to date or outstanding. In the case of corporations that are already defaulting on payments from 2012 to 2015, the National Registry will collect the amount owed and transfer the money to the CR Tax Office.

Starting September, 1st 2017, the law grants:

Three months to pay the fees accumulated from 2012 to 2015 without any fine or penalties, if the corporation is not already dissolved due to lack of payment of the tax as per former law 9024.

Twenty-four months for the legal representatives to resign from their positions and avoid any liability.

Twelve months to transfer assets without paying the transfer tax, but only if these transfers are made within companies that have been inactive before the CR Tax Office for at least 24 months prior to the enactment of this law.

At GM Attorneys, we will be more than glad to analyze with you the best course of action on your specific scenario.