As a real property and/or CR corporation owner in Costa Rica, you should be aware about taxes that need to be paid yearly. Failure to pay them would generate penalties and lead to a collection process.

LUXURY TAX: Due date: January 15th, 2018

The Solidarity Tax for the Strengthening of Housing Programmes (Impuesto Solidario para el Fortalecimiento de Programas de Vivienda), known as ‘luxury tax’ only applies to houses, condos, apartments, over a certain construction value (126.000.000 colones in 2017, more less US$ 229K, this amount adjusts each year). The amount of tax to be paid goes on a scale from 0.25% to 0.55% per year, depending on the value of the Property.

Those liable for this tax shall fill out the form called ‘Formulario Único de Inscripción, Declaración y Pago Impuesto Solidario para el Fortalecimiento de Programas de Vivienda, Ley 8683’ every 3 years, and, pay anully the tax.

ANNUAL CORPORATE TAX: Due date: January 30 th, 2018

Staring on September1st, 2017 all corporations, subsidiaries, and limited liability companies that are currently registered before the National Registry, as well as all entities incorporated in the future, will be subject to pay an annual. Law 9428: ‘Tax over legal entities’

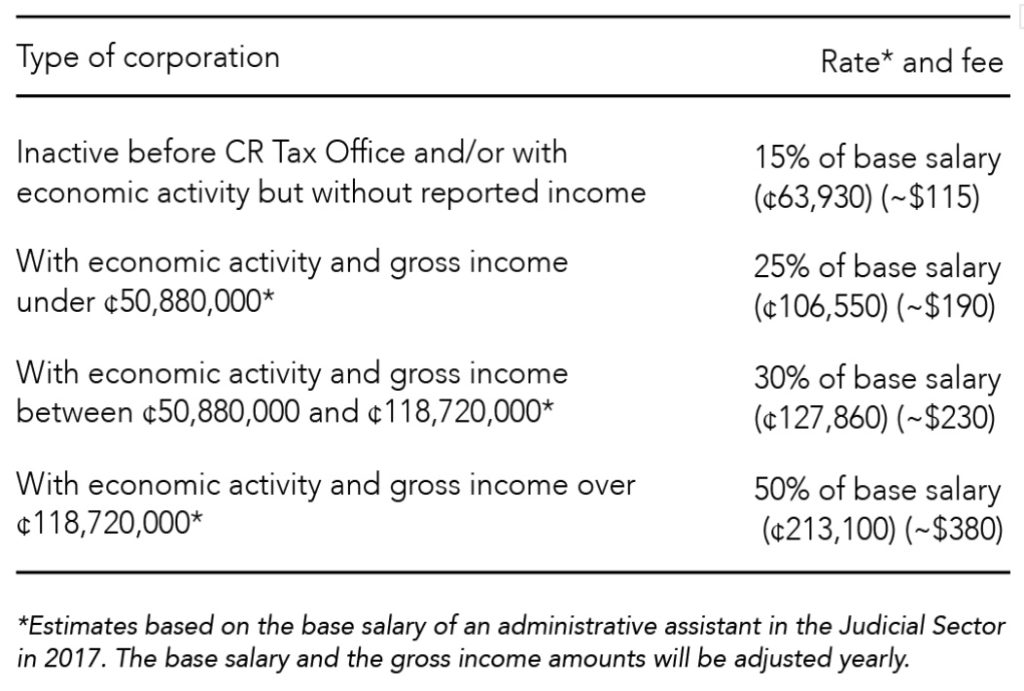

Amount: There will be a fixed fee for inactive corporations and a progressive rate for active corporations depending on their income. As of today, the tax will be as stated below: