On October 8, 2018, CONASSIF (National Council for Financial System Supervision) approved a new regulation, SUGEF Agreement 11-18, related to the registration and de-registration process with SUGEF (General Superintendence of Financial Institutions) of obligated individuals and entities that perform one or more of the activities described in Articles 15 and 15 bis of Law 7786, the later, related to money laundering and financing of terrorism regulation for DNFBP´s (Designated Non-Financial Businesses and Professions).

Public notaries have been excluded from SUGEF supervision, and will be supervised in the matter by a specialized unit of the General Directorate of Notaries. SUGEF Agreement 11-18 will become effective as of January 1, 2019.

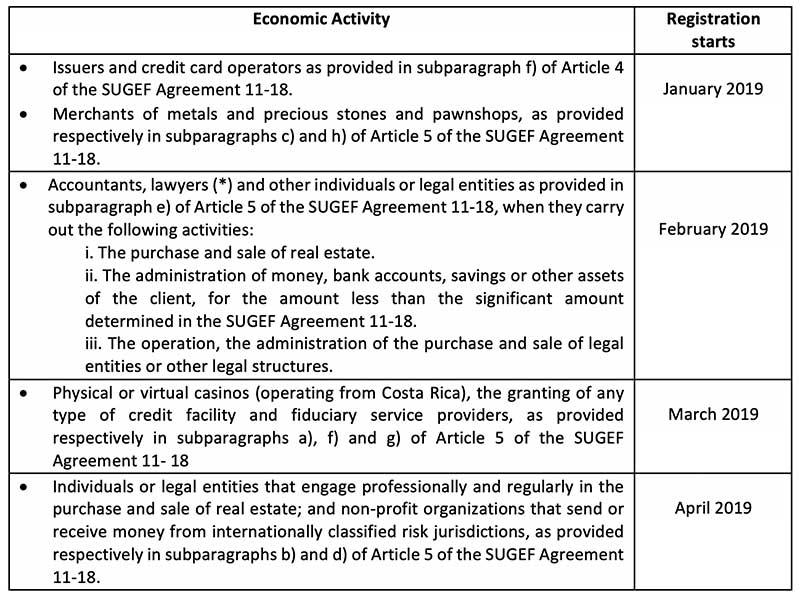

It must be emphasized that risk of severe administrative and economic sanctions in the event of breaches of regulations, with significant reputational consequences, besides that the supervised financial entities are authorized to close all accounts, products or services provided to the obligated party, please see below the deadlines:

What are the activities subject to registration by Article 15 bis of Law 7786?

With respect to Article 15 bis, it refers to the ‘Designated Non-Financial Activities and Professions’ (DNFBP´s), a term coined FATF (Financial Action Task Force). As a result of FATF evaluation performed on Costa Rica in 2015, the consequent recommendations to the Government of Costa Rica aimed at strengthening the Costa Rican legal framework for the prevention of money laundering and financing of terrorism.

Specifically, article 15 bis of Law 7786 establishes: ‘Individuals and legal entities that develop any of the following DNFBP´s must submit to registration and supervision by SUGEF, among them:

Individuals or legal entities that engage professionally and regularly in the purchase and sale of real estate, including, but not limited to, brokers, intermediaries, developers, as well as developers of real estate projects.

Individuals and legal entities, as well as lawyers and accountants, except salaried professionals with respect to their supervised public or private employer, when they are prepared to carry out transactions or carry out transactions for their clients on the following activities:

The purchase and sale of real estate.

The administration of money, bank accounts, savings, securities or other assets of the client, for the amount less than the significant amount determined in this Regulation (US$400,000.00 or its equivalent in other currencies).

The operation and administration of the purchase and sale of legal entities or other legal structures.

Fiduciary service providers, including those involved in the creation, registration and administration of trusts, in the amount less than the significant amount determined in these Regulations. Excluded from this registry are suppliers of guarantee trusts, testamentary trusts, custody or possession of assets.

Individuals or legal entities that grant any type of credit facility, when this activity is carried out in a manner, organized, habitual and use for their operation the accounts of entities supervised by any of the Superintendence overseen by CONASSIF.

If you have any doubts or concerns, please contact us, we will be more than to advice and help you with the registration.