With the approval of the Law #9635, among the taxes and changes that brought, it was created a Capital Tax Gains of 15% which applies to investment income and real estate. With the approval of the Law # 9635, among the taxes and changes that brought, it was created a Capital Tax Gains of 15% The new law will begin on July 1, 2019. Capital Gains taxes can be a very complicated subject. We will try and streamline the tax law for you in this article.

Capital Gains taxes are collected on Capital Income when you sell real estate or an investment and have a gain. As an example of an investment would be a restaurant with assets and rights such as equipment and the name. If you sell real estate or an investment at a loss, no tax is collected.

What is Capital Income?

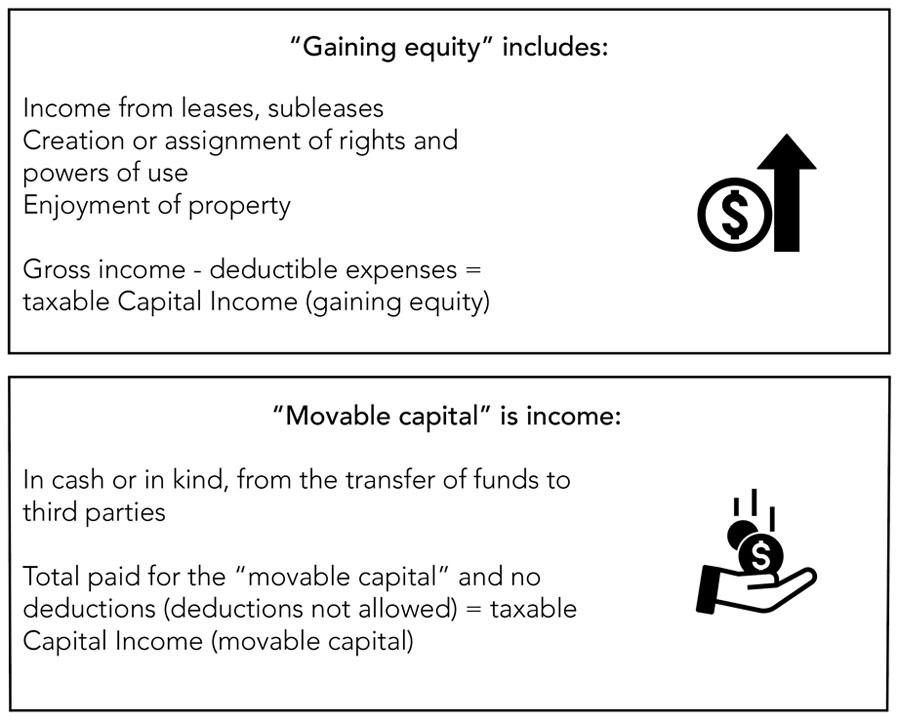

Capital Income is defined as ‘gaining equity’ or ‘movable capital’

The taxable Capital Income from Capital Gains is the difference between the acquisition values of the assets or rights and the amount received on the transfer (transfers with consideration). Under all other assumptions (e.g. transfers without consideration), the taxable income is the market value of the assets or rights that are included in the taxpayer’s assets or equity.

What if I sell my home?

If you are a resident of Costa Rica and own property, the property you live in is considered your primary home. Your primary residence is exempt from the payment of Capital Gains taxes when you sell that property. You will only have to pay capital gains tax when selling an investment property.

The law is not yet defined with how long you must live in your residence for it to be considered a ‘primary residence’. We will update you when that becomes defined.

The primary home can be registered in the seller’s personal name or a CR corporation, as long as you can prove that it is the shareholders’ primary home.

If your primary home is outside of Costa Rica and you own a second home (pleasure) in Costa Rica, you will pay capital gains tax when you sell your property in Costa Rica.

Exemption and deductible expenses

For real estate, the law has a one-time exemption for those property owners that own real estate before the law comes into effect on July 1, 2019. Those owners may take this one-time exemption and pay 2.25% Capital Gains tax upon the sale of the property. The Capital Gains tax of 2.25% is paid off of the gross income of the sale.

In regards to expense deductions, the taxpayer (seller) is allowed to deduct 15% from the gross income of the sale, without providing proof of the expenses, and with no possibility of taking another deduction for those expenses.

The 15% deduction increases to 20% for non-financial investment funds.

Important notes:

– If you own 2 or more properties in Costa Rica, as of July 1, 2019, you will pay a Capital Gains tax on the sale of your property unless it is your primary residence.

– The payment of the Capital Gains tax is due by the 15th of the month after a sale closing.

– The seller is responsible for paying the Capital Gain taxes, not the buyer.

– Income Tax (tax you pay on income from your job, pension, professional fees, etc.) is paid separately from Capital Gain taxes

Like most tax laws, The Capital Gains tax law has many more details than this article can cover, so it is very important to consult with an attorney to fully understand your specific circumstances. We are at your service at gmattorneyscr.com.